Barbara's Birthday Sale Starts SOON!

Barbara's Birthday Sale Starts SOON!

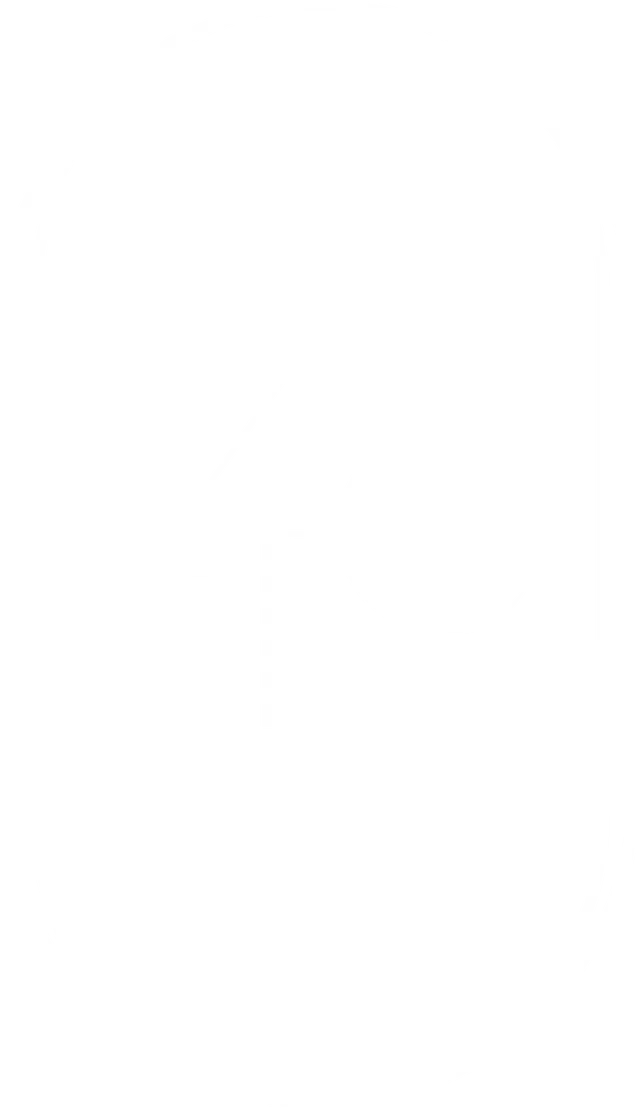

Write Off Your Real Estate™

Hurry!

USE CODE: '333RE' at checkout for $333 Off!

90% of millionaires attribute their wealth to their real estate portfolio.

And let’s be honest—they are gaining that wealth because of the tax advantages in real estate

If you’ve ever seen a fellow business owner showing off their brand spanking new Mercedes G-Wagon over on the ‘gram and thought to yourself:

“I wish I had one of those”...

...or felt annoyed when you learned that you could have been paying your mortgage interest and utility bills (meaning the cleaning person, pool guy, and landscaper) through the business instead of out of your own pocket...

You’re not alone.

Nope—you’ve just fallen for the same trap I see countless business owners fall into:

They build their business.

They're creating killer cash flow and consistent revenue.

But they never get to fully enjoy the fruits of their labor.

WHY?

‘Cause they pay way more in taxes than they need to.

Benefiting from real estate tax strategies does not have to be:

Complicated and confusing

Something only the wealthy do

Time-consuming

If there is anyone that can make tax talk fun, accessible and easy to understand—

It's me!

So what would you do with an extra $20K-$30K?

Because that’s the kind of tax-saving money we are talking about inside the course:

Write Off Your Real Estate™

Whether you are looking to buy, sell, or hold there are so many tax strategies available to you that can help you lower your tax burden so you can gain financial freedom!

WHEN YOU SIGN UP FOR THE WRITE OFF YOUR LIFE COURSE NOW...

You will get access to an exclusive VIP group

starting February 5th.

I will be in this group daily, answering your questions and going live every day for the week to ensure you feel confident AF in maximizing your tax deductions and saving money on your tax bill!!

Write Off Your Real Estate™ Will Help You Gain Massive Wealth By Teaching Tax Strategies Available to Real Estate Investors Like You

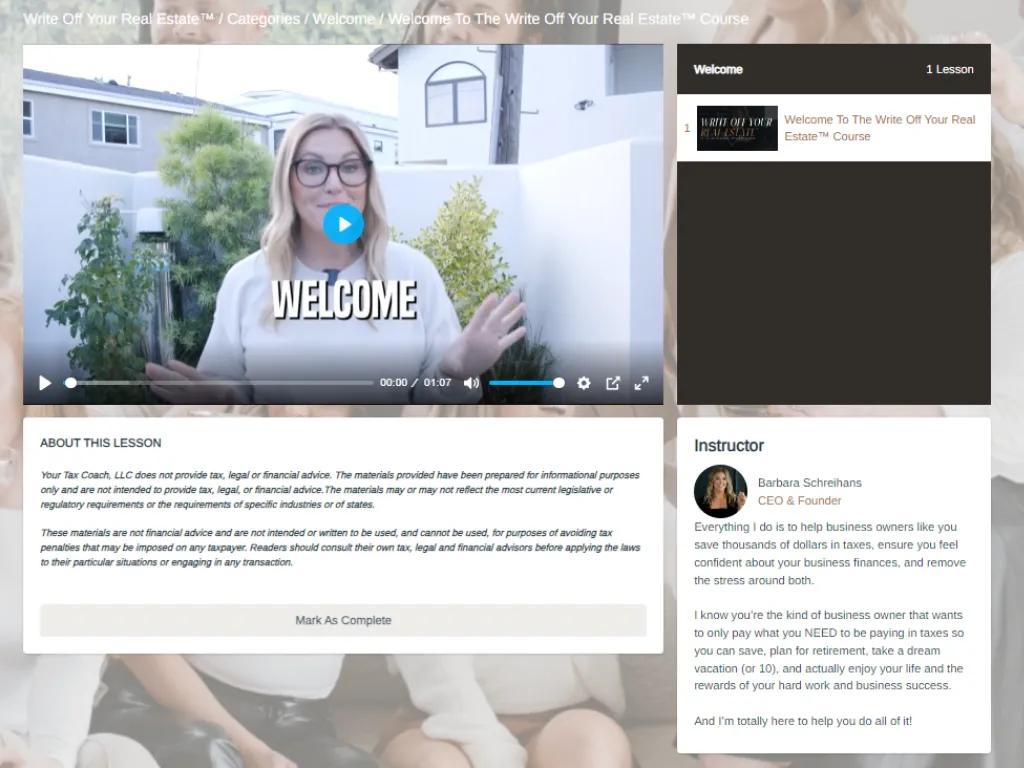

Inside the course, you will get…

Video Modules

Dozens of videos teaching

tax strategies for buying, holding, selling, 1031 exchange, PLUS SO MUCH MORE

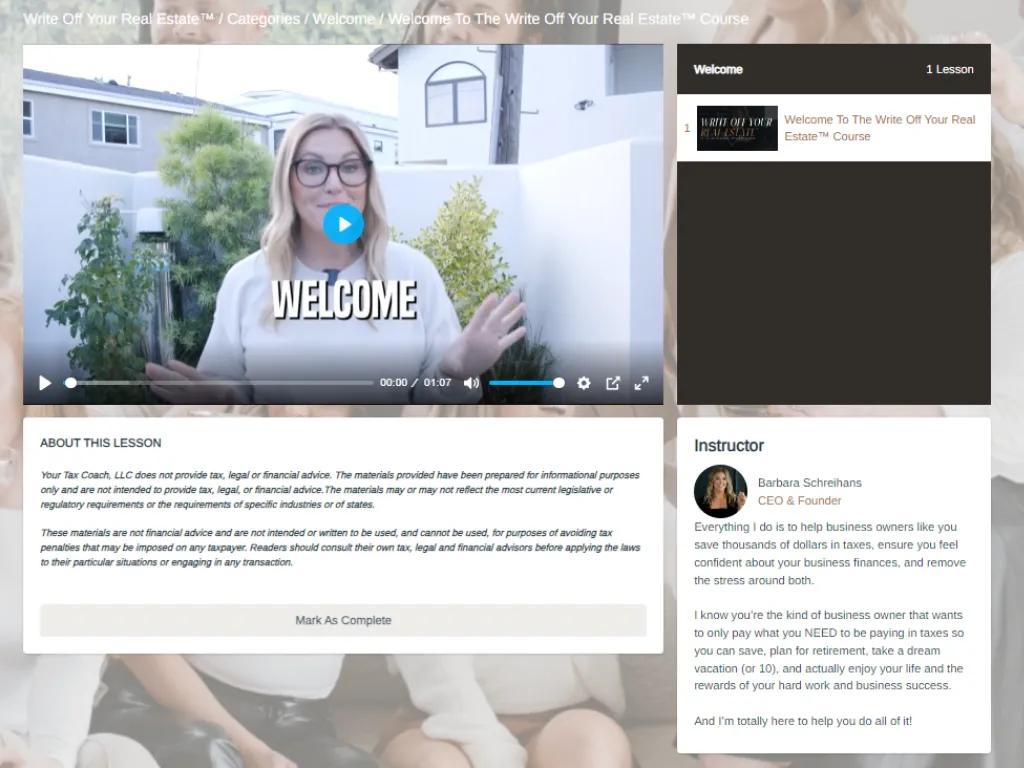

Guides and Logs

Resources that will keep you

organized and make it simple to

save money on your taxes

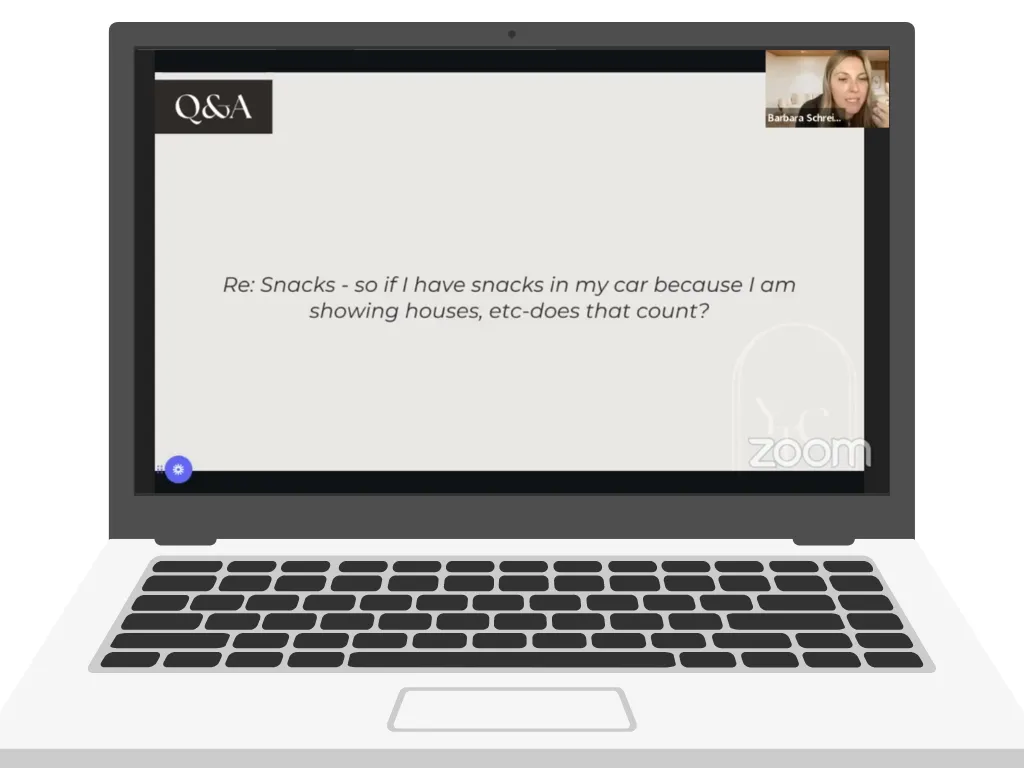

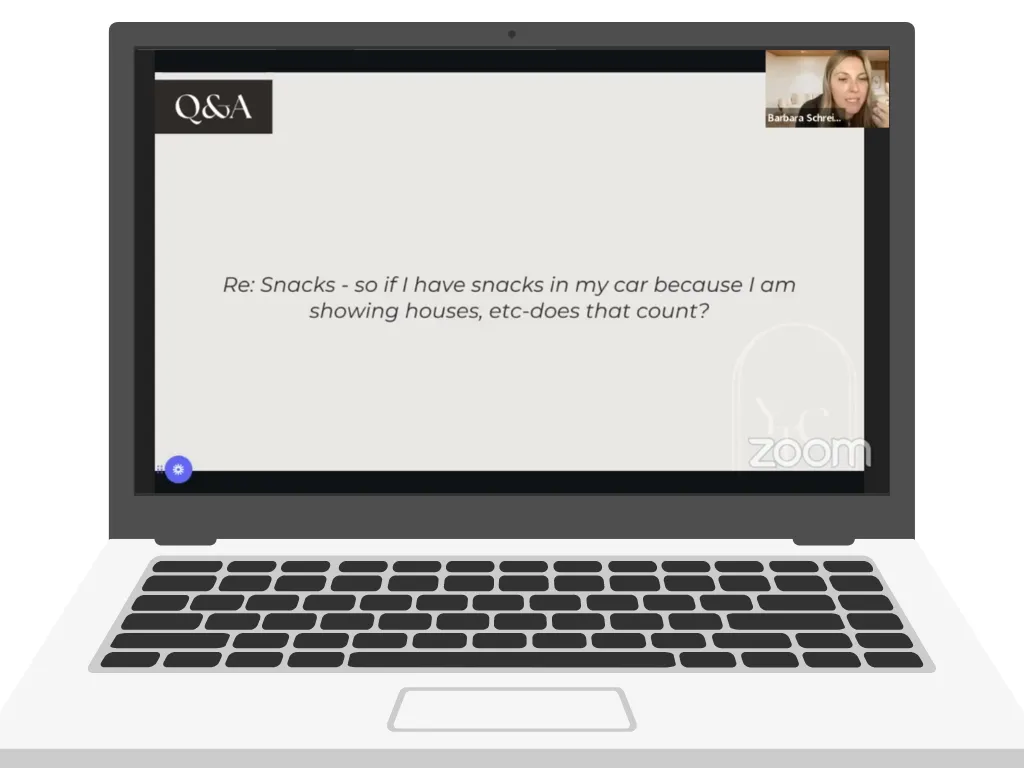

Live Q&A

Ask your specific real estate tax strategy questions during a live Q&A with

Your Tax Coach (must purchase by 3/29)

PLUS, you will also get access to a private community full of real estate investors!

Write Off Your Real Estate™ Will Help You Gain Massive Wealth By Teaching Tax Strategies Available to Real Estate Investors Like You

Inside the course, you will get…

Video Modules

Dozens of videos teaching

tax strategies for buying, holding, selling, 1031 exchange, PLUS SO MUCH MORE

Guides and Logs

Resources that will keep you

organized and make it simple to

save money on your taxes

Live Q&A

Ask your specific real estate tax strategy questions during a live Q&A with Your Tax Coach (must purchase by 3/29)

PLUS, you will also get access to a private community full of real estate investors!

Pull up a chair because there is more…

Inside Write Off Your Real Estate™ you will gain access to:

Guide to Becoming a Real Estate Professional (valued at $497)

Real Estate Professional Hours Log (valued at $297)

Cost Segregation Guide (valued at $497)

Deductions for Short-Term Rentals (valued at $497)

Business Basics Guide (valued at $497)

Vehicles + RV Deductions (valued at $497)

Meals Deduction Resource (valued at $497)

Travel Deduction Guide and Log (valued at $697)

Income and Expense Template for Rentals (valued at $297)

BONUS:

Write Off Your Life Masterclass—Learn how to turn expenses into business deductions (valued at $997)

Cost Segregation Masterclass—Learn the ins and outs of depreciation, a money-saving tax strategy (valued at $997)

“Your Tax Coach team is legit MINDBLOWING INCREDIBLE! If you aren't working with this powerhouse team then you're doing it wrong. I will continue to work with Barbara and her team as they are top-notch in their field, kind, professional, and efficient. Their knowledge is worth every penny and then some.”

– Elizabeth P.

YOU’LL ALSO LEARN SOME OF THE BASICS YOU NEED TO KNOW FOR FEELING MORE EMPOWERED AND IN CONTROL OF YOUR TAXES AND BUSINESS FINANCES

You’ll learn:

What expenses and deductions are

How to document them properly

And execute them so they save thousands of dollars each and every year.

Plus, the modules will consistently be updated with the ever changing tax

laws so you can rest assured you’ve got the most recent, LEGAL tax

deductions guidance in your back pocket.

I see way too many people overpaying the IRS.

That means you are giving Uncle Sam more of your hard-earned money than you need to be.

Promise me this:

2024 is the year you stop doing that!

When you lack the knowledge of real estate tax incentives, you miss out on lucrative opportunities.

But not anymore—when you join:

Just imagine the possibilities for you and your family when you start:

Implementing money-saving tax strategies

Retaining more of your profits

Reinvesting them back into your portfolio

And now you’re watching your wealth grow exponentially….

That's the future I’m committed to helping you achieve.

Gain immediate access so you can start building massive wealth in 2024

$1,497

PAY IN FULL

1 Payment of $1497

PAYMENT PLAN

2 Payments of $799

PAYMENT PLAN

4 Payments of $444

(And YES, this course is also a write off!)

Have we met yet?

I’m Barbara – Your Tax Coach.

My whole mission is to help business owners and real estate investors like you save thousands of dollars in taxes.

I believe your money is yours – not the government’s and I have created a proven system for permanent tax reduction.

Because I know you’re the kind of person who only wants to pay what you NEED to be paying in taxes so you can save, build generational wealth, take a dream vacation (or 10), and enjoy your life and the rewards of your hard work and success.

And I’m totally here to help you do all of it!

PAY LESS IN TAXES, KEEP MORE OF YOUR MONEY FOR YOURSELF AND LIVE THE CEO LIFESTYLE WITH MY "TRIPLE E METHOD"

With Write Off Your Life™, I want you to walk away feeling educated, empowered and eased, which is why I designed my Triple E method to get you there.

PHASE 1:

Get educated by learning what expenses and deductions are.

Large Call to Action Headline

PHASE 2:

Feel empowered through knowing how to simply document your deductions and easily create your own Profit + Loss statement.

Large Call to Action Headline

PHASE 3:

Feel eased knowing that you're about to save thousands of dollars in taxes each and every single year (+ no more interrupted sleep when tax season rolls around!)

Large Call to Action Headline

PHASE 1:

Get educated by learning what expenses and deductions are.

PHASE 2:

Feel empowered through knowing how to simply document your deductions and easily create your own Profit + Loss statement.

PHASE 3:

Feel eased knowing that you're about to save thousands of dollars in taxes each and every single year (+ no more interrupted sleep when tax season rolls around!)

“My CPA had touched on a lot of this but it was over a course of YEARS working with him and I still had so many questions. Your course hit all of them with so much detail to back it up! I’m feeling so confident! I also love that I can reference it whenever I need!”

– Jessica H.

Get The Answers You’re Looking For

Is this course for beginners, or is it geared toward experienced investors?

I designed this course for individuals at all levels of experience in real estate investing. Whether you're just starting out or you're a seasoned investor looking to fine-tune your tax strategy, I feel confident this course will help you save a sh*t ton of money.

Will this course cover both residential and commercial real estate investments?

Yes, this course covers tax strategies applicable to both residential and commercial real estate investments. I dive into strategies that are relevant across various property types!

Will the course cover recent updates or changes to tax laws affecting real estate investors?

If you’ve ever bought a course from Your Tax Coach—you know I am continuously updating and adding modules as tax laws and regulations change.

Do the tax strategies taught in this course apply to my specific location?

While tax laws may vary state by state in the United States, the strategies taught in Write Off Your Real Estate are designed for all.

Your Tax Coach Newsletter

Stay up to date with all things taxes and how to keep more of your money in your pocket!

By providing my phone number, I agree to receive text messages from the business.