The #1 Tax Strategy Firm

The Firm 6 and 7-Figure Entrepreneurs Use to Save $10K–$250K+ Every Single Year

Done-for-you tax strategy that helps you keep way more of what you make – 100% legally.

And yes, our fees are a tax-deductible business expense.

Average client saves $40,000+ per year in taxes

Built for business owners making $250K+/year and paying $20K+ in taxes

Enrollment takes less than 10 minutes – no sales call required

The Tax Strategy Firm 6 and 7-Figure Entrepreneurs

Use to Save $10K–$250K+ Every Single Year

Done-for-you tax strategy, tax prep, and (optional) bookkeeping

that helps you keep way more of what you make – 100% legally.

And yes, our fees are a tax-deductible business expense.

You’re using pre-tax dollars to buy a plan that lowers your taxes even more.

Average client saves $40,000+ per year in taxes

Built for business owners making $250K+/year and paying $20K+ in taxes

Enrollment taxes <10 minutes – no sales call required

PREFER TO TALK FIRST?

( Book a call instead 📅 )

The #1 Tax Strategy Firm

The Tax Strategy Firm 6 and 7-Figure Entrepreneurs Use to Save $10K–$250K+

Every Single Year

Done-for-you tax strategy that helps you keep way more of what you make – 100% legally.

And yes, our fees are a tax-deductible business expense.

Average client saves $40,000+

per year in taxes

Built for business owners making $250K+/year and paying $20K+ in taxes

Enrollment takes less than 10 minutes

- no sales call required

Why This Matters

As a business owner, taxes are usually your single biggest expense.

If your household makes over $250,000/year, you’re probably overpaying by $30,000+ every single year simply because no one has proactively strategized your taxes.

Most accountants file last year’s story.

We rewrite this year’s story – before the money goes to the IRS.

HOW

DOES

THIS

WORK?

First, we'll gather all of your tax information, goals, and expected income for the business so that we can provide you with a tax strategy summary prior. We want all of our clients to save more in the first year than the initial fee they pay!

Then we’ll dive into our vault of super secret tax strategies and find ALL the applicable tax strategies that we can implement in your business. Some of the things we'll look into include: deduction review and maximization, legal entity optimization, and liability minimization. We'll use this information to prepare the tax strategy summary for you to show just how much $$$ we can save you!

After you’ve recovered from the shock of seeing how many thousands of dollars you’ll be able to stop paying the IRS and start putting towards your next dream vacation, we’ll sign our working contract and you’ll pay the initial fee for the service (this can be broken up into monthly payments).

We’ll then have a 60-minute strategy intensive where we'll outline the relevant strategies for you and your business (keeping it all jargon free!) and show you how we'll work together to save on your taxes each year by implementing each of the strategies.

What You Get As a Strategy Client

Your Personalized

Tax Strategy

Your Dedicated

Tax Strategist

Your Entire

Tax Support Team

Year-Round Access

Monthly Support & Reviews

A step-by-step plan showing exactly how much we can save you - most clients see $10K–$250K+/year in potential savings.

Your Personalized Tax Strategy

A step-by-step plan showing exactly how much we can save you - most clients see $10K–$250K+/year in potential savings.

Your Dedicated Tax Strategist

Someone who knows your business, investments, and goals, and proactively finds tax-saving opportunities for your family.

Your Entire Tax Support Team

Tax strategists + preparers behind the scenes making sure everything is done right and documented.

Year-Round Access

(Not Just Tax Season)

Never wonder “Can I write this off?” again. Ask questions anytime via our client portal, text, or email.

Monthly Support & Reviews

We keep you compliant, optimized, and profitable - all year long.

Someone who knows your business, investments, and goals, and proactively finds tax-saving opportunities for your family.

Tax strategists + preparers behind the scenes making sure everything is done right and documented.

Never wonder “Can I write this off?” again. Ask questions anytime via our client portal,

text, or email.

We keep you compliant, optimized, and profitable - all year long.

What Your Strategy Package Includes

Custom annual tax savings plan

60–90 minute implementation call

Quarterly strategy calls

Year-round Q&A access

Investment, Year 1:

$2,200/month for 12 months, or

$24,200 pay-in-full (1 month free)

Investment, Year 2 and beyond:

$1,100/month (maintenance & ongoing optimization)

Package 2 – All-In

(Strategy + Tax Prep + Bookkeeping)

For owners who want everything in one place.

Includes:

Everything in Strategy Only, plus:

Monthly bookkeeping (ongoing and/or cleanup as needed)

Investment, Year 1:

$3,500/month for 12 months, or

$38,500 pay-in-full (1 month free)

Investment, Year 2 and beyond:

$2,400/month

(maintenance & ongoing optimization)

Bookkeeping is optional.

If you’re in our strategy program, you are required to do tax preparation with us so your strategy and your returns perfectly match.

Package 2 – All-In

(Strategy + Tax Prep + Bookkeeping)

For owners who want everything in one place.

Includes:

Everything in Strategy Only, plus:

Monthly bookkeeping (ongoing and/or cleanup as needed)

Investment, Year 1:

$3,500/month for 12 months, or

$38,500 pay-in-full (1 month free)

Investment, Year 2 and beyond:

$2,400/month

(maintenance & ongoing optimization)

Bookkeeping is optional.

If you’re in our strategy program, you are required to do tax preparation with us so your strategy and your returns perfectly match.

How It Works (3 Simple Steps)

Step 1

Step 2

Step 3

Deep-Dive Implementation Call

Your Personalized Tax Savings Blueprint

12 Months of Hands-On Implementation & Optimization

After you enroll, you’ll book a 60–90 minute implementation call with our tax strategist.

We dive into your businesses, entities, investments, and financial goals so we can see exactly where you’re overpaying today and where the biggest opportunities are for you and your spouse.

We audit your returns, books, and structure, then build your strategy, including:

Entity optimization

Deduction maximization

Payroll & compensation strategy

Retirement & investment integration

Legal tax shelters and advanced strategies (when appropriate)

You’ll receive a clear Tax Savings Summary showing how much we can help you save each year.

We implement the plan with you over a full year:

A strategy call to walk you through every move

Our team handling your business and personal tax preparation

Ongoing support to keep everything compliant, optimized, and updated as your life and business change

You’re not getting a PDF.

You’re getting a tax strategy partner for the year.

How It Works

(3 Simple Steps)

Step 1 – Deep-Dive Implementation Call

After you enroll, you’ll book a 60–90 minute implementation call with our tax strategist.

We dive into your businesses, entities, investments, and financial goals so we can see exactly where you’re overpaying today and where the biggest opportunities are for you and your spouse.

Step 2 – Your Personalized Tax Savings Blueprint

We audit your returns, books, and structure, then build your strategy, including:

Entity optimization

Deduction maximization

Payroll & compensation strategy

Retirement & investment integration

Legal tax shelters and advanced strategies (when appropriate)

You’ll receive a clear Tax Savings Summary showing how much we can help you save each year.

Step 3 – 12 Months of Hands-On Implementation & Optimization

We implement the plan with you over a full year:

A strategy call to walk you through every move

Our team handling your business and personal tax preparation

Ongoing support to keep everything compliant, optimized, and updated as your life and business change

You’re not getting a PDF.

You’re getting a tax strategy partner for the year.

Is This For You?

This is for you if:

You make $250K+/year

You pay $20K+ per year in taxes as a family

You feel like you’re doing “good”… but not keeping enough

You’ve never had anyone proactively strategize your taxes

Your accountant only talks to you at tax time

You want a team to tell you exactly what to do to stop overpaying

You want a tax plan that grows with your business and your life

You’re in the U.S. (we serve clients in all 50 states)

Real Client Story

Multi–Six-Figure Tax Savings for a 30-Year Business Owner

Karen and her husband came to us saying:

“We’re not wealthy – we’re just trying to retire and see our grandkids.”

Here’s what we helped unlock:

Found $30,000 in missed deductions in minutes.

Her plumbing company had $30K of inventory stuck on the balance sheet. We reclassified it — instant $30K deduction + lower taxable income this year.Identified a $120,000–$200,000 cost segregation opportunity.

Their Phoenix commercial building had never been cost-segregated. We mapped the study, coordinated it, and used the depreciation to wipe out mobile home park income and carry losses forward for future tax-free years.Made passive income nearly tax-free

We restructured how rent flows between their businesses, allowing cost seg losses to offset two years of passive income.

Added an HRA + HSA to make medical expenses deductible

Thousands saved every year on costs they used to pay personally.

Cleaned up 30 years of bookkeeping errors

Removed outdated assets, corrected distributions, fixed depreciation gaps, and eliminated red flags — lowering property tax and increasing audit protection.

Built a retirement plan that grows tax-free

Roth IRAs, Solo 401(k), and long-term HSA investing = decades of tax-free compounding.

Total impact: multiple six figures in tax savings, immediately and over the next several years bringing their retirement goals much closer.

Risk Free Enrollment

Risk Free Enrollment

Hiring a tax strategy firm is a big decision.

You deserve peace of mind.

Our promise:

If we can’t identify at least the cost of your investment in legal, implementable tax savings for your first year, we’ll keep working with you at no additional fee until we do.

You’re either saving more than you spend with us – or we haven’t finished our job.

Still On The Fence About Switching Accountants?

“I don’t have time.”

You don’t need time. We do the work.

Your entire tax strategy requires about 4 hours of your time per year, and it can save you tens of thousands.

Four hours to save $20K… $50K… even $100K isn’t a time issue. It’s a priority issue.

“It’s hard to switch accountants.”

It feels big in your head.

In reality, it’s simple.

We write the breakup email for you.

We request everything we need.

Your old accountant is legally required to send your records.

You don’t lift a finger — we handle it kindly, cleanly, and professionally.

“It’s too expensive.”

Not having a strategy is expensive.

Most business owners we meet are overpaying the IRS by $15,000–$65,000 every single year.

Our fee is a write-off, and our strategy is designed to pay for itself — every year.

We don’t cost you money. We stop the bleeding.

“I don’t have time.”

You don’t need time.

We do the work.

Your entire tax strategy requires about 4 hours of your time per year, and it can save you tens of thousands.

Four hours to save $20K… $50K… even $100K isn’t a time issue.

It’s a priority issue.

“It’s hard to switch accountants.”

It feels big in your head.

In reality, it’s simple.

We write the breakup email for you.

We request everything we need.

Your old accountant is legally required to send your records.

You don’t lift a finger — we handle it kindly, cleanly, and professionally.

“It’s too expensive.”

Not having a strategy is expensive.

Most business owners we meet are overpaying the IRS by $15,000–$65,000 every single year.

Our fee is a write-off, and our strategy is designed to pay for itself — every year.

We don’t cost you money.

We stop the bleeding.

“I’m scared of getting audited.”

Strategy is not risky. Sloppiness is.

We only use IRS-compliant, battle-tested strategies.

No shady schemes.

When things are documented properly, you don’t fear the IRS — you’re prepared for them.

“I’m embarrassed about how messy my books are.”

Totally normal. Most business owners feel this way.

Your books are not a moral failing — they’re just data.

Our team loves cleanup. We turn chaos into clarity.

No judgment. Only strategy.

“But I like my accountant / they’ve been with me for years.”

You can like them as a human and still recognize their lack of strategy is costing you thousands.

If a friend cost you $40K a year, would you stay loyal… or choose your financial future?

This isn’t about loyalty.

It’s about legacy.

“I’m scared of getting audited.”

Strategy is not risky. Sloppiness is.

We only use IRS-compliant, battle-tested strategies. No shady schemes.

When things are documented properly, you don’t fear the IRS — you’re prepared for them.

“I’m embarrassed about how messy my books are.”

Totally normal.

Most business owners feel this way.

Your books are not a moral failing

— they’re just data.

Our team loves cleanup. We turn chaos into clarity. No judgment. Only strategy.

“But I like my accountant / they’ve been with me for years.”

You can like them as a human and still recognize their lack of strategy is costing you thousands.

If a friend cost you $40K a year, would you stay loyal… or choose your financial future?

This isn’t about loyalty. It’s about legacy.

FAQ's

Are your fees tax-deductible?

Yes. In most cases, our fees are a tax-deductible business expense. You’re using pre-tax dollars to buy a strategy designed to lower your taxes even more.

Does the strategy include my spouse?

Yes. You pay taxes as a family, so your plan covers all businesses, investments, and goals for you and your spouse.

Do I have to use you for tax preparation?

Yes. If you’re in our strategy program, we prepare your business and personal returns so your strategy and your filing are perfectly aligned. You are not required to use our bookkeeping.

How much is tax preparation?

Our most common tax prep package is one business return + one personal return for $4,350, paid once per year. More complex situations (multiple entities, states, or returns) are quoted individually.

Can I keep my current bookkeeper?

Yes. You can keep your bookkeeper, or use ours as part of the all-in package. Bookkeeping is optional. Strategy + tax prep with our team is required.

Who is this really for?

Business owners making $250K+/year and paying $20K+ in taxes as a family, who want proactive strategy, year-round access, and a long-term partner instead of a once-a-year tax filer.

How much time do I need to commit?

Plan on 2–3 hours in month one (implementation call + document upload). After that, we keep you on track with focused check-ins while our team does the heavy lifting.

What happens after the first year again?

You can continue as a maintenance/optimization client at the reduced rates:

- Strategy Only: $1,100/month

- All-In: $2,400/month

What if you don’t find enough savings for me?

If we can’t identify at least the cost of your investment in legal, implementable tax savings, we keep working with you at no additional fee until we do.

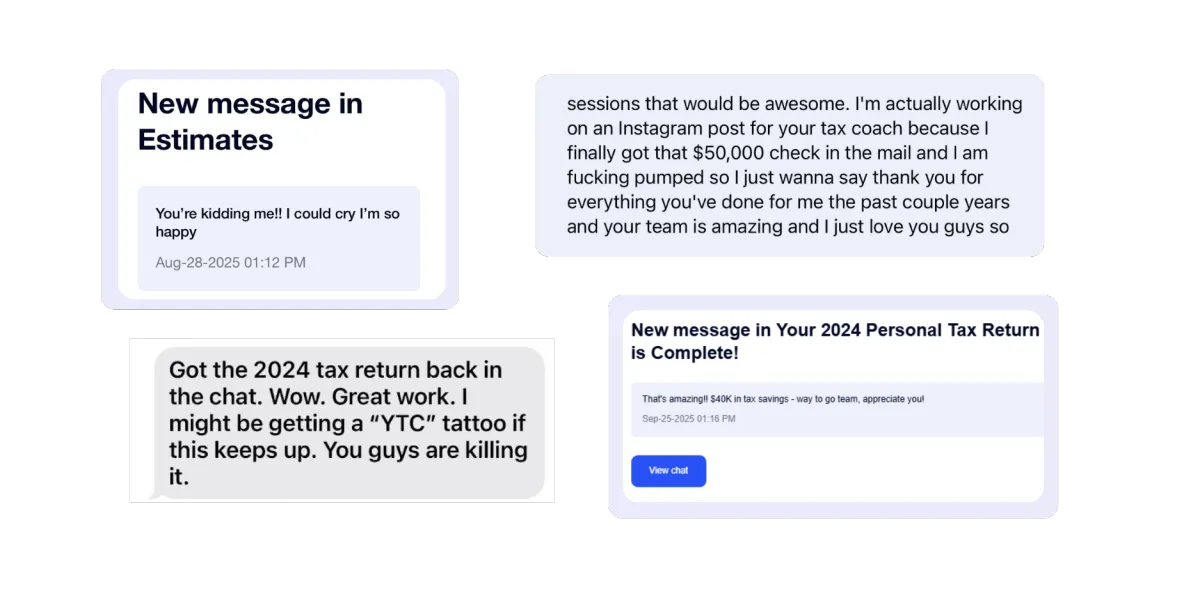

This is what happens when you stop overpaying, start planning, and finally have a strategist in your corner.

This is what happens when you stop overpaying, start planning, and finally have a strategist in your corner.

How Jamie Turned Tax Savings Into a Luxury Speakeasy (And Set Her Kids Up To Be Millionaires)

Meet Jamie - a mid-thirties, fully booked, premium-priced hairstylist in California.

From the outside, she was crushing it.

On paper? She was handing $60,000+ to the IRS every year and assuming, “I guess this is just what successful people pay.”

Then she hired Your Tax Coach.

Step 1: We Looked Backward - and Found Almost $100K She’d Already Overpaid

When we amended her past tax returns, here’s what shook out:

2021: $96,000 in missed deductions → $58,125 refunded

2022: $65,661 in missed deductions → $37,064 refunded

Total cash back from past mistakes: $95,189.

Money she had already earned… but never should have lost.

Step 2: We Fixed the Future

For 2023, Jamie had us in her corner from day one. Before YTC: she owed over $60,000/year.

After strategy:

She owed just $5,461 to the IRS

California sent her a $6,369 refund

That’s $60,000+ saved in a single year — with the same structure now protecting her for 2024 and beyond.

Step 3: What She Did With the Savings

Jamie didn’t use her savings to buy a purse — she used it to build wealth:

She bought a bar and transformed it into a luxury Bay Area speakeasy

She’s now shopping for her first Airbnb investment property

She’s building a path for her kids to become future millionaires

Jamie went from dreading tax season…

to using the tax code to buy businesses, expand her income streams, and change her family’s financial trajectory forever.

This is what happens when you stop overpaying, start planning, and finally have a strategist in your corner.

Most clients save 2–10x their investment with us every single year.

This is not an expense.

This is a wealth-building decision.

We cap new strategy clients each year to protect quality.

Secure online checkout.

We’ll follow up within 1 business day with your onboarding link.

Financial Disclaimer:

Your Tax Coach provides education, guidance, and tax strategy based on current IRS regulations and best practices.

We do not guarantee or promise any specific amount of tax savings, financial results, or business outcomes. Your results will always depend on your individual circumstances, your business structure, your financial data, and your willingness to implement the strategies provided.

Nothing on this page or inside our services should be interpreted as financial, legal, or investment advice specific to your situation. Tax laws change, and recommendations may vary based on those changes.

You are responsible for your own financial decisions. Your Tax Coach does not make any guarantees regarding income, savings, or the success of any strategies discussed.

The Newsletter

The Podcast

Get Around

© Your Tax Coach 2020-2024 | PRIVACY POLICY | TERMS AND CONDITIONS | DISCLAIMER | SITE & SYSTEM CREDIT